Birdwatching Mastery Blog

Explore the world of birdwatching with tips, guides, and inspiration.

Riding the Crypto Rollercoaster: How Volatility Shapes Your Wallet

Discover the wild world of crypto volatility! Learn how market swings can boost or bust your wallet in our thrilling blog ride.

Understanding Crypto Volatility: What It Means for Your Investments

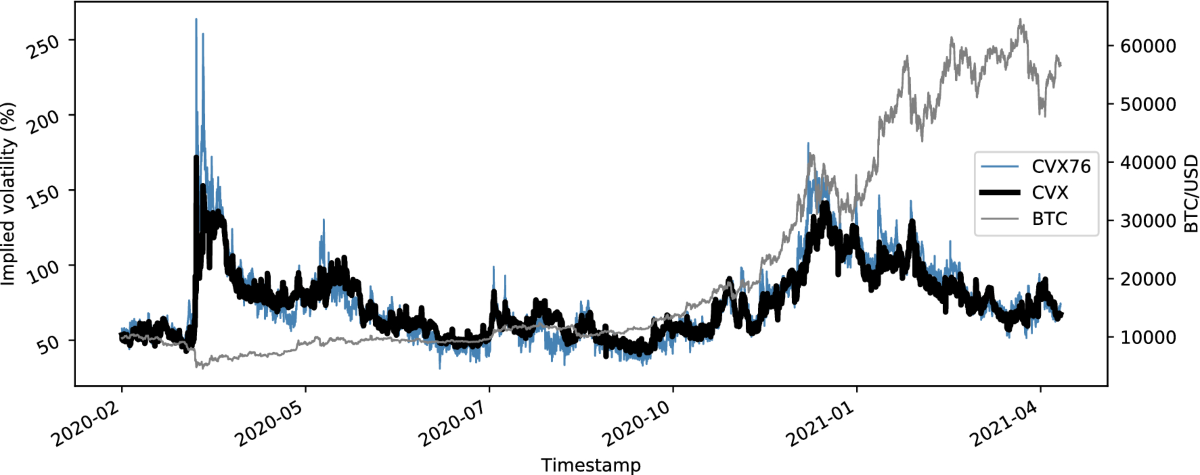

Understanding crypto volatility is essential for any investor looking to navigate the exciting yet unpredictable world of cryptocurrencies. Unlike traditional markets, digital currencies tend to experience extreme price fluctuations due to factors such as market sentiment, regulatory news, and technological advancements. These sudden changes can lead to potential gains, but they also pose significant risks. For investors, comprehending the underlying causes of volatility can help in making informed decisions and developing effective risk management strategies.

One way to gauge crypto volatility is through metrics such as the Volatility Index (VIX), which measures the market's expectation of future price fluctuations. Additionally, it’s important to recognize that while high volatility can offer lucrative trading opportunities, it also increases the likelihood of losses. Investors should consider diversifying their portfolios, employing stop-loss orders, and staying updated on market trends to mitigate the impact of unexpected price swings. By understanding the dynamics of crypto volatility, you can better position yourself to seize both opportunities and challenges in the cryptocurrency market.

Counter-Strike is a popular first-person shooter game that involves team-based gameplay and strategy. Players can compete in various game modes, working together to either complete objectives or eliminate the opposing team. For those interested in gaming-related promotions, you can check out a cloudbet promo code to enhance your gaming experience.

Top Strategies to Manage Your Wallet During Market Swings

Market swings can be daunting for investors, but with the right strategies in place, you can manage your wallet effectively. One important strategy is to maintain a well-diversified portfolio. This means spreading your investments across various asset classes, such as stocks, bonds, and real estate, to cushion against market volatility. Additionally, consider implementing a rebalancing strategy at regular intervals to ensure your investment mix aligns with your risk tolerance and investment goals.

Another effective approach is to set a clear budget for your investments and stick to it, particularly during turbulent times. This involves determining how much you can allocate towards high-risk investments while ensuring you have a safety net in place. Utilize tools like stop-loss orders to protect your investments from unnecessary losses. Lastly, staying informed about market trends and financial news will empower you to make educated decisions and manage your wallet during those unpredictable market fluctuations.

Is Cryptocurrency Volatility a Friend or Foe?

The world of cryptocurrency is often characterized by its volatility, leading many to wonder if it acts as a friend or a foe for investors. On one hand, the rapid price fluctuations present lucrative opportunities for traders. Those skilled in market analysis can capitalize on volatile trends, buying low and selling high to maximize profits. This potential for quick gains can draw in new investors, eager to ride the waves of price surges that cryptocurrencies such as Bitcoin and Ethereum frequently experience.

Conversely, the same volatility that attracts investors can also pose significant risks. Sudden market downturns can wipe out investments in a matter of hours, creating a sense of uncertainty and anxiety among less experienced traders. For many, the psychological toll and financial instability associated with steep price declines can outweigh the benefits of potential profits. Therefore, understanding the nature of cryptocurrency volatility is crucial for anyone looking to navigate this complex landscape, balancing the thrill of potential reward against the peril of substantial loss.