Birdwatching Mastery Blog

Explore the world of birdwatching with tips, guides, and inspiration.

The Cloak of Crypto: How Anonymity Shapes Digital Currency Platforms

Discover how anonymity influences digital currency platforms and learn the secrets behind crypto's mysterious cloak!

Understanding the Role of Anonymity in Cryptocurrency Transactions

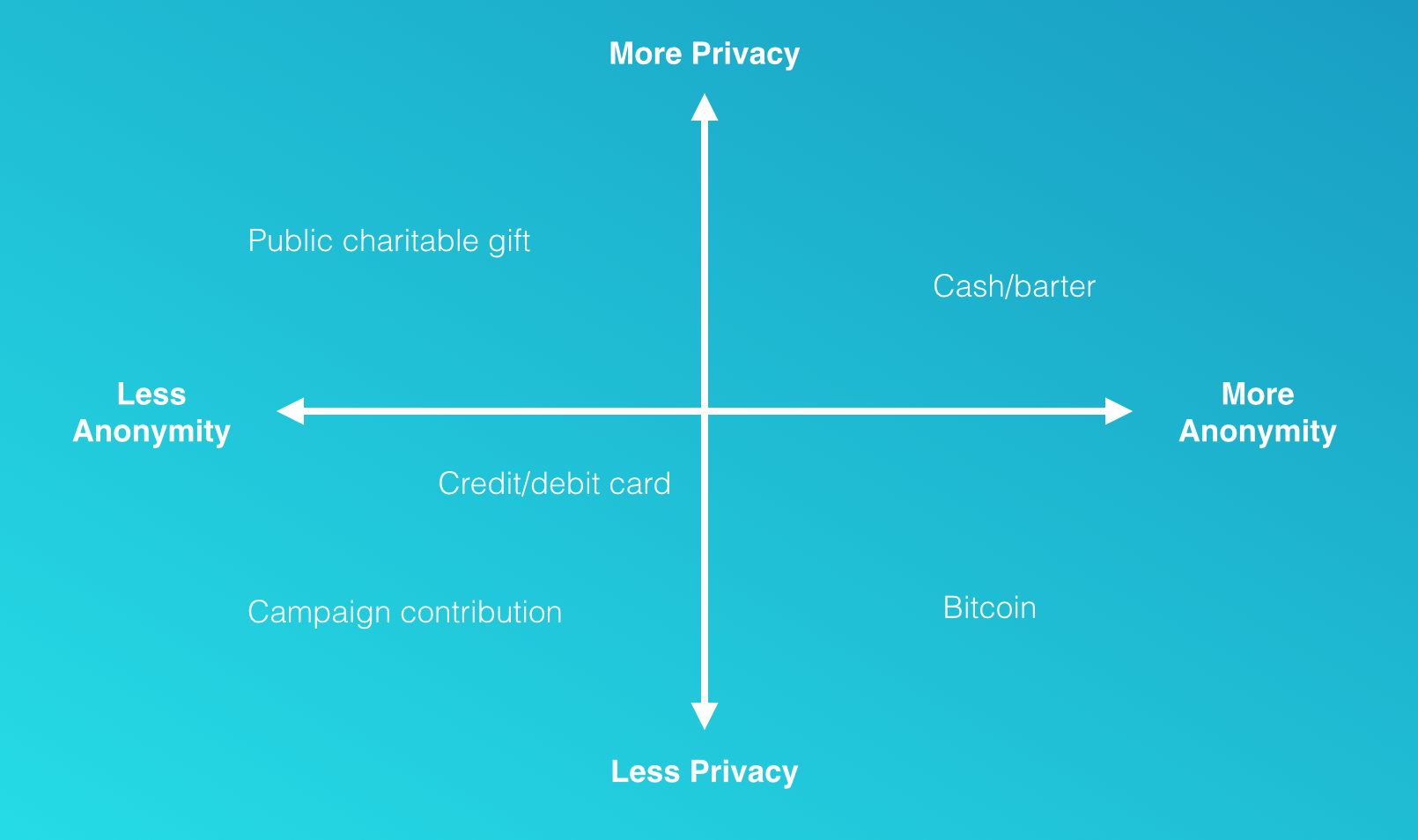

In the digital age, the concept of anonymity has become increasingly significant, particularly within the realm of cryptocurrency transactions. Unlike traditional banking systems that require personal details and identification, cryptocurrencies such as Bitcoin and Monero allow users to interact without disclosing their identities. This attribute provides a layer of privacy that appeals to many, especially those who prioritize security and wish to maintain control over their financial activities. However, this anonymity can also attract illicit activities, leading regulators to seek ways to balance privacy with compliance.

The role of anonymity in cryptocurrency transactions is multifaceted. On one hand, it empowers individuals by safeguarding their financial data from potential breaches and misuse. On the other hand, it poses challenges for law enforcement agencies trying to combat cybercrime. The emergence of privacy coins, which enhance transactional confidentiality, further complicates this landscape. As the debate surrounding financial privacy evolves, it becomes essential for both users and policymakers to understand the implications of anonymity in the cryptocurrency space, ensuring that innovation does not come at the cost of security and accountability.

Counter-Strike is a popular first-person shooter game that involves team-based gameplay, where players can choose to play as terrorists or counter-terrorists. For a unique twist on gaming experiences, you might want to check out a cryptocasino.com promo code that offers exciting bonuses. The game has evolved through various versions, captivating millions of gamers worldwide.

The Dark Side of Digital Currency: Anonymity and Its Implications

The rapid rise of digital currency has revolutionized the financial landscape, offering users unprecedented anonymity. While this feature is often touted as a primary benefit, it also harbors a dark side that raises serious ethical and legal questions. Many individuals are attracted to the idea of financial transactions free from government surveillance, yet this very anonymity can facilitate illicit activities. From money laundering to the purchase of illegal goods on the dark web, the lack of traceability provided by cryptocurrencies can leave law enforcement at a significant disadvantage.

Moreover, the implications of anonymity extend beyond criminal activities. It can undermine established financial systems and contribute to the erosion of regulatory frameworks. Governments struggle to implement regulations due to the decentralized nature of digital currencies, which often operate outside traditional banking systems. This chaos has led to a dual-edged sword: while proponents argue for the benefits of privacy and freedom, critics warn that unchecked anonymity can enable harmful behaviors, destabilizing economies and putting individuals at risk.

How Anonymity in Crypto is Reshaping Financial Privacy and Security

The rise of cryptocurrency has brought anonymity to the forefront of financial transactions, reshaping the landscape of financial privacy and security. As individuals increasingly seek to protect their identities from prying eyes, cryptocurrencies like Bitcoin, Monero, and Zcash offer varying degrees of anonymity, allowing users to conduct transactions without revealing personal information. The ability to send and receive funds confidentially not only enhances personal privacy but also empowers individuals in jurisdictions where financial activities are heavily monitored or restricted.

Moreover, the implications of anonymity in crypto extend beyond just individual privacy; they challenge traditional financial systems and regulatory frameworks. For instance, while anonymity can help safeguard legitimate transactions, it also poses risks such as facilitating illicit activities. This dual nature has sparked a debate among regulators, tech advocates, and financial institutions about how to balance financial privacy with the need for security and compliance. As the crypto landscape continues to evolve, finding this equilibrium will be crucial in ensuring that financial privacy can coexist with robust security measures, ultimately leading to a more empowering, secure, and private financial ecosystem.