Birdwatching Mastery Blog

Explore the world of birdwatching with tips, guides, and inspiration.

Blockchain: The Invisible Hand of Tomorrow's Economy

Discover how blockchain is shaping the future of our economy—unlock the secrets to tomorrow's financial revolution!

Understanding Blockchain: How It Shapes the Future of Our Economy

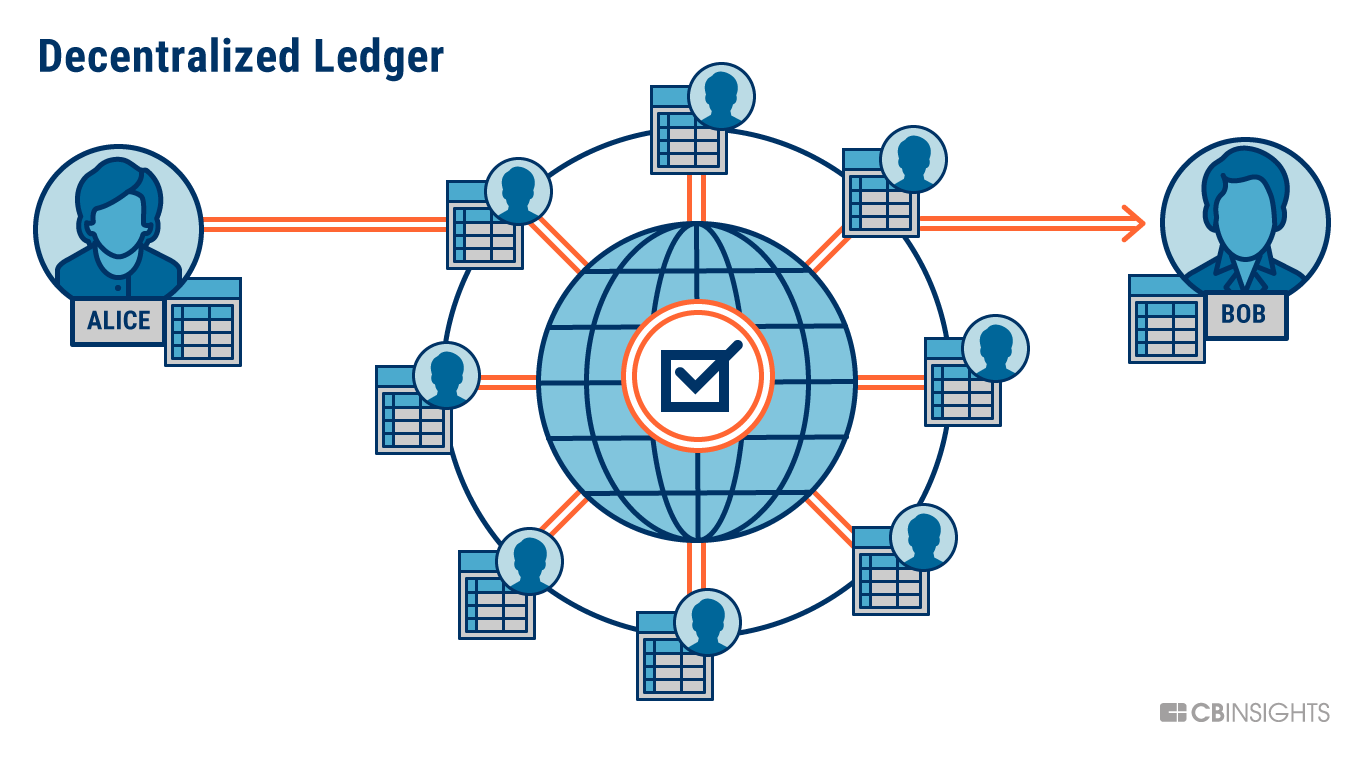

Understanding Blockchain is crucial as we move towards an increasingly digital world. At its core, blockchain is a decentralized ledger technology that enables secure and transparent transactions. Unlike traditional banking systems, which rely on central authorities for verification, blockchain operates on a peer-to-peer network, allowing users to make transactions directly with one another. This innovation not only reduces transaction costs but also enhances trust among participants, paving the way for new business models and economic strategies.

The influence of blockchain extends far beyond cryptocurrencies like Bitcoin. Industries such as supply chain management, healthcare, and finance are harnessing its potential to improve efficiency and accountability. For instance, in supply chains, blockchain can offer real-time tracking of goods, ensuring transparency in every step of the process. Additionally, smart contracts, which automatically execute agreements when conditions are met, are revolutionizing how businesses operate. As understanding blockchain becomes essential for businesses and consumers alike, its role in shaping the future of our economy cannot be overstated.

Is Blockchain the Key to Financial Inclusion in Tomorrow's World?

Financial inclusion is a critical issue in today's global economy, where millions remain unbanked and lack access to essential financial services. Blockchain technology has emerged as a potential game changer in addressing this challenge. By enabling peer-to-peer transactions without the need for intermediaries, blockchain offers a decentralized and transparent approach to financial services. For instance, remittances can be processed at a fraction of the cost and time compared to traditional banking methods, making it easier for individuals in remote areas to access funds and manage their money efficiently.

Moreover, blockchain's ability to provide a secure and tamper-proof ledger can enhance trust in financial transactions, particularly in developing regions where corruption and fraud are prevalent. In tomorrow's world, this technology could facilitate access to credit, insurance, and savings products for underserved populations. As we look forward, the integration of blockchain in financial systems holds the potential to bridge the gap between the banked and unbanked, fostering greater economic participation and ultimately promoting overall growth and stability.

The Role of Smart Contracts in Revolutionizing Modern Business Transactions

Smart contracts are transforming the landscape of modern business transactions by automating and securing processes that traditionally required intermediaries. These self-executing contracts, with the terms of the agreement directly written into code, operate on blockchain technology, ensuring transparency and immutability. Businesses can streamline their operations by utilizing smart contracts for various applications, including:

- Automated payment processing

- Supply chain management

- Digital identity verification

- Decentralized finance transactions

One of the main advantages of smart contracts is their ability to reduce costs and increase efficiency. By removing the need for middlemen, such as lawyers or banks, businesses can save time and resources, allowing them to focus on core operations. Moreover, these contracts are designed to minimize disputes through clear, predefined terms that are executed automatically when conditions are met. This revolutionary approach not only enhances trust between parties but also fosters innovation in business models across various industries.