Birdwatching Mastery Blog

Explore the world of birdwatching with tips, guides, and inspiration.

Why Your Next Insurance Quote Could Be a Game Changer

Unlock hidden savings! Discover how your next insurance quote could transform your coverage and save you money. Don't miss out!

Unlocking Savings: How Your Next Insurance Quote Could Transform Your Coverage

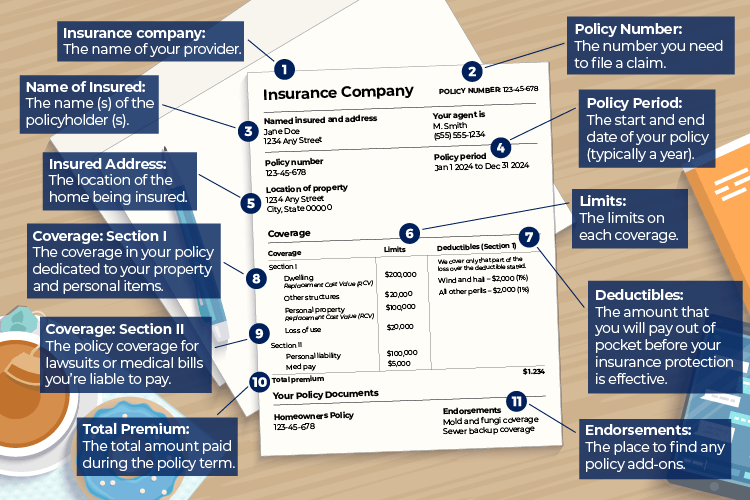

When it comes to unlocking savings, obtaining your next insurance quote may be more transformative than you think. With the rise of online comparison tools, consumers have the power to easily evaluate multiple policies side by side. This not only helps you understand the coverage options available, but it can also highlight potential savings that might have gone unnoticed. It's essential to consider not just the premium costs, but also factors like deductibles, limits, and what your rate will look like after potential claims.

Additionally, transforming your coverage doesn't always mean sacrificing quality for cost. By leveraging your insurance quotes, you can identify discounts you may qualify for — such as bundling different policies like home and auto, or reductions for maintaining a good credit score. For further insights on maximizing your savings, check out this informative guide from Forbes. Taking the time to review and compare your insurance options can ensure you not only save money but also secure the best possible protection for your assets.

The Hidden Benefits of Getting Multiple Insurance Quotes

When it comes to securing an insurance policy, many individuals overlook the importance of obtaining multiple insurance quotes. Not only does this practice allow you to compare coverage options and premiums from various providers, but it also gives you insight into the specific features offered. For instance, some insurers may provide additional discounts for bundling policies, while others might have specific benefits tailored to your needs. By seeking out multiple estimates, you can pinpoint the best deals and ensure that you are not leaving money on the table. For more details, you can refer to Investopedia.

Moreover, getting multiple quotes is a great way to educate yourself about the insurance market and develop your negotiation skills. Armed with knowledge about different policies, you can effectively advocate for better terms and rates. This competitive advantage not only helps you secure a favorable insurance policy but also enhances your understanding of what constitutes good coverage. Additionally, having options can lead to increased satisfaction with your chosen insurer, as you are more likely to select a policy that genuinely meets your needs. For further insights, check out NerdWallet.

Are You Paying Too Much? How to Evaluate Your Next Insurance Quote Effectively

When it comes to evaluating your next insurance quote, it's essential to ask yourself, Are you paying too much? Understanding the components of an insurance policy can help you identify areas where you might be overpaying. Begin by comparing quotes from multiple insurers; tools like Bankrate can provide valuable insights. Look closely at key factors such as premiums, deductibles, coverage limits, and any additional fees. Additionally, reviewing your current policy against your needs can reveal if you're paying for coverage you no longer require.

Another crucial step in evaluating insurance quotes is to analyze discounts that different companies offer. Many insurers provide savings for bundling policies, maintaining good driving records, or even having certain safety features in your home. Sites like The Zebra can help you understand which discounts may be applicable. Lastly, don’t hesitate to negotiate with your insurer; often, simply asking for a better rate can lead to significant savings. In the end, thorough research and careful evaluation will ensure you're not just getting a good deal, but the best insurance coverage for your needs at a fair price.