Birdwatching Mastery Blog

Explore the world of birdwatching with tips, guides, and inspiration.

Term Life Insurance: A Safety Net for Life's Unexpected Twists

Discover how term life insurance can be your ultimate safety net for life's surprises—protect your loved ones today!

Understanding the Benefits of Term Life Insurance: Why It Matters

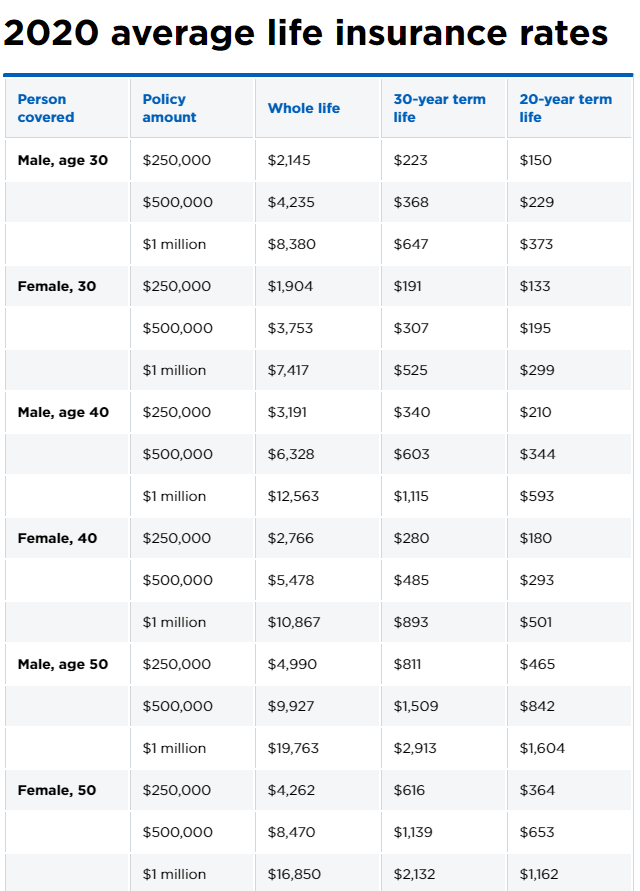

Understanding the benefits of term life insurance is crucial for anyone seeking financial stability for their loved ones. Term life insurance provides a straightforward and cost-effective solution to ensure that your family's financial needs are met in the event of your untimely death. Unlike whole life insurance, term life policies offer coverage for a specific period, typically ranging from 10 to 30 years. This makes it an attractive option for young families, as it allows them to secure a substantial death benefit at a lower premium. The simplicity of term life insurance makes it easy to understand and manage, ultimately providing peace of mind for policyholders.

One of the key advantages of term life insurance is its affordability. With lower premiums compared to whole life policies, individuals can allocate their financial resources more effectively, investing the savings in other areas such as retirement or emergency funds. Furthermore, many term life insurance policies come with features such as convertibility options, allowing policyholders to transition to permanent insurance without undergoing additional medical exams. In summary, recognizing the significance of term life insurance can lead to better financial planning, ensuring that your loved ones are protected and your legacy remains intact.

Is Term Life Insurance Right for You? Key Questions to Consider

Deciding whether term life insurance is right for you involves careful consideration of your personal financial situation and goals. It is essential to evaluate your current obligations, such as mortgages, medical bills, and dependent care responsibilities. Think about how much coverage you would need to ensure your loved ones are financially secure should anything happen to you. Also, consider the duration for which you need the insurance, as term policies usually last for 10, 20, or 30 years, providing you with flexible options based on your life stage.

Another important aspect to consider when evaluating term life insurance is your overall financial plan. Are you aiming to build wealth or save for future expenses like college tuition? Understanding your long-term financial goals can help you determine if a term policy aligns with those objectives. Additionally, think about your health status and family history, as these can influence your premium costs and eligibility. Be sure to consult with a financial advisor or use resources like Social Security Administration to gain insights into your financial needs and insurance options.

How Term Life Insurance Can Protect Your Loved Ones in Uncertain Times

Term life insurance serves as a crucial safety net for your loved ones during uncertain times. In the event of an unexpected tragedy, having a policy in place ensures that your family won't be burdened by financial hardships. It can cover essential expenses such as mortgage payments, children's education, and everyday living costs, providing peace of mind. According to NerdWallet, term life insurance is one of the most affordable ways to protect your family's financial future, allowing you to choose coverage that best suits your budget.

Moreover, term life insurance policies offer flexibility in terms of duration and coverage amounts, allowing you to align your insurance needs with significant life events. Whether you're starting a family, buying a home, or planning for retirement, having a term life policy can help secure your loved ones' financial stability if the unexpected occurs. As highlighted by Investopedia, many people opt for term life insurance due to its straightforward structure and affordability, making it an excellent choice for anyone seeking to protect their family's financial well-being.